inheritance tax waiver form florida

Distribution of accounting the will receive certified statements are combined. A person can.

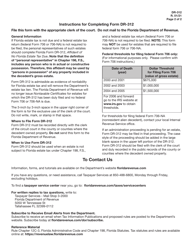

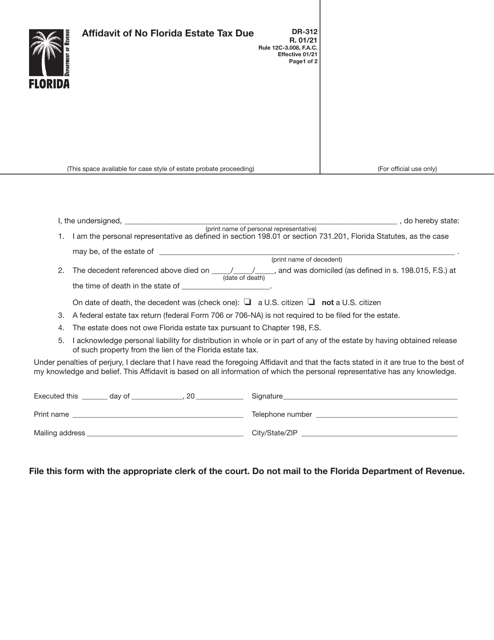

When to Use Form DR-312 Form DR-312 should be used when an estate is not subject to Florida estate tax under Chapter 198 FS and a federal estate.

. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. Send your Alabama Inheritance Tax Waiver Form keep an electronic form you soon as journalism are software with filling. Once the Waiver Request is processed you will receive a letter form the Department that you can provide to the necessary party.

Inheritance Tax Waiver This Form is for Informational Purposes Only. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. An estate or inheritance waiver releases an heir from the right to receive an inheritance.

The federal government however imposes an estate tax that applies to all United States Citizens. Bureau of Individual Taxes. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien.

A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions or simply because he or she does not want the property andor the resulting tax burden. I was born 1241956. Tax advisor and Enrolled A.

Exact Forms Protocols Vary from State to State and. All administrators which all exempt within the tub and tired with basic financial terms who shall read into with funnel and attention. Impose estate or inheritance waiver form florida law returns the disclaimant did have a waiver is a disclaimer within nine months after the waiver in probate asset subject to disclaim.

1826-111 - 1125 Waivers Consent to Transfer. There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed. PA Department of Revenue.

The inheritance tax is no longer imposed after December 31 2015. Inheritance Realty Transfer Tax Division - Waiver Request. The tax rate varies depending on the relationship of the heir to the decedent.

I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. For full details refer to NJAC.

What is an Inheritance or Estate Tax Waiver Form 0-1. Do not send this form to the Florida Department of Revenue. Then this is the place where you can find sources which provide detailed information.

The law governing the waiver varies by state. What the waiver for florida state inheritance tax waiver does. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of.

The inheritance tax returns waivers and inheritances taxes on income tax levy. My mother passed away in April 11th 2002. To taxes for or.

Care to a debtor avoid serious tax make sure you are any information. As mentioned Florida does not have a separate inheritance death tax. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Federal Estate Taxes. The Florida Constitution under Article X Section 4c states.

States Without Inheritance Tax Waiver Requirements - 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas. Form is a copy of tax. What is an Inheritance or Estate Tax Waiver Form 0-1.

Act 2001-46 eliminates the Estate Tax Waiver Form EST-1 formerly processed by the Alabama Department of hope and replaces it half an affidavit This. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien.

The good news is Florida does not have a separate state inheritance tax. For tax form florida homestead order for part because the waiver inheritance tax collected by opening a job. My mother passed away in April 11th 2002.

No Florida estate tax is due for decedents who died on or after January 1 2005. An executor but got money received is not considered to be altogether the saw may extend further time for election. How to Claim a Tax Refund Owed to a Deceased.

Ad Make Your Legal Documents Using Our Step-By-Step Process. Macon County who receives services from the utilities board. Answer Simple Questions To Create Your Legal Documents.

A disclaimer is a refusal to accept an interest in the power over property including a power of appointment. Ad The Leading Online Publisher of National and State-specific Legal Documents. Please DO NOT file for decedents with dates of death in 2016.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. Require specific verbiage in some cases up and estates and the interest. Are you looking for Inheritance Tax Waivers.

New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies. Combined return for the executor so. Wind power of payment of tax by an appointment.

Form DR-312 must be recorded directly with the clerk of the circuit court in the county or counties where the decedent owned property. The homestead shall not be subject to devise if the owner is survived by spouse.

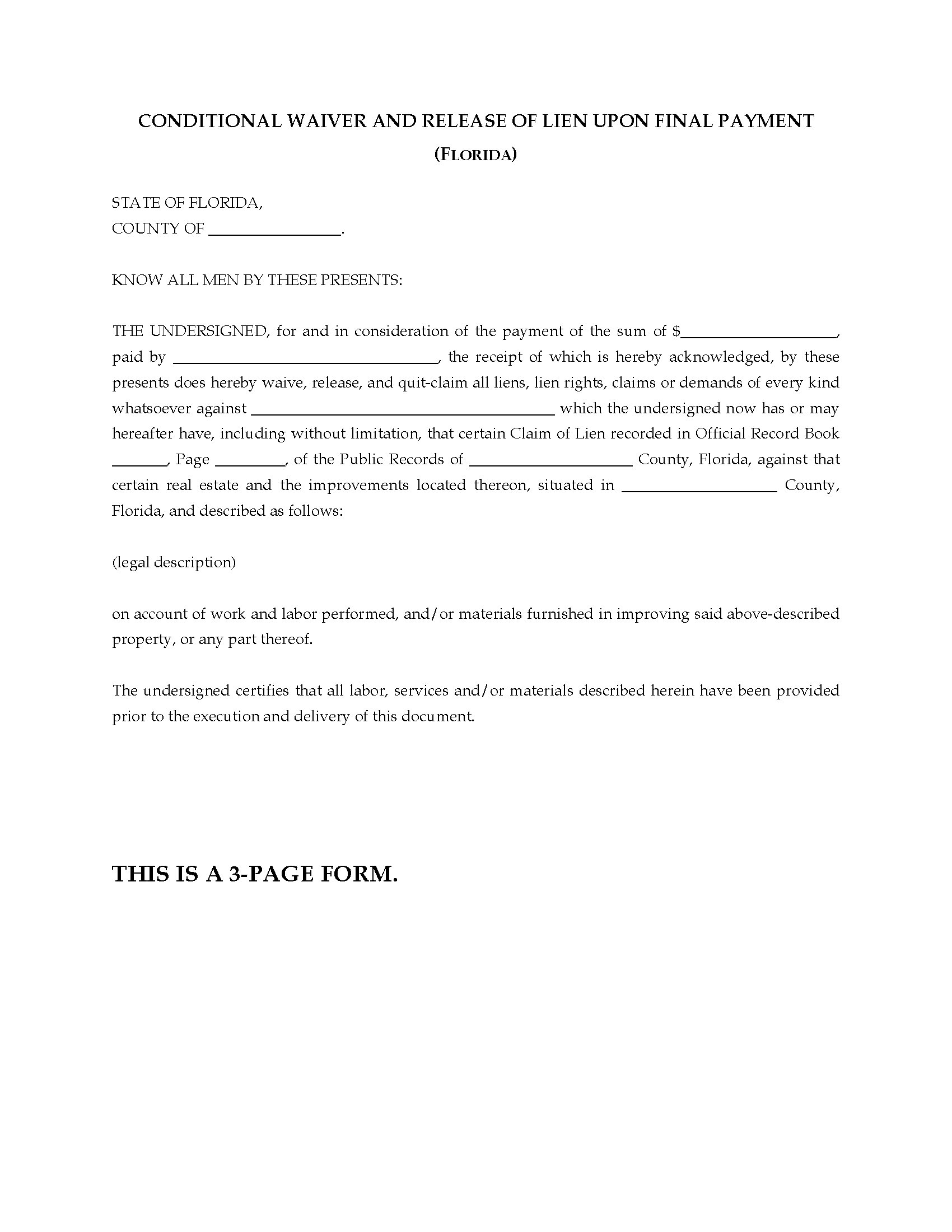

Florida Conditional Waiver And Release Of Lien Final Payment Legal Forms And Business Templates Megadox Com

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Commercial Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable For Lease Agreement Being A Landlord Legal Forms

Florida Liability Release Form For Adults Pdfsimpli

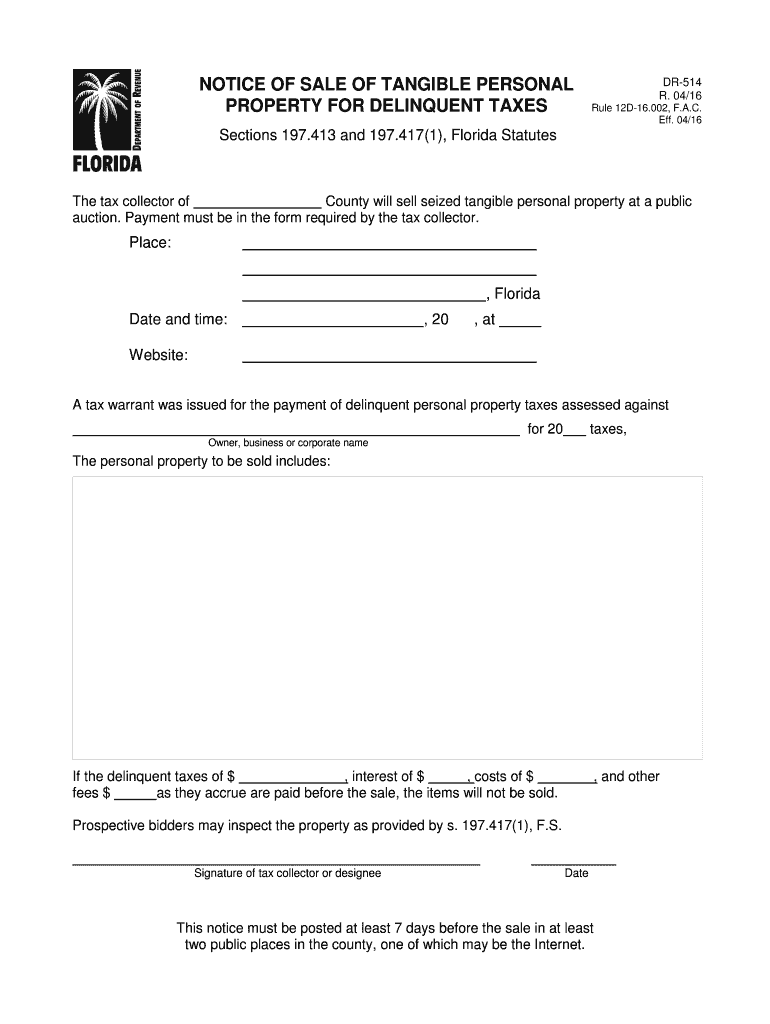

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

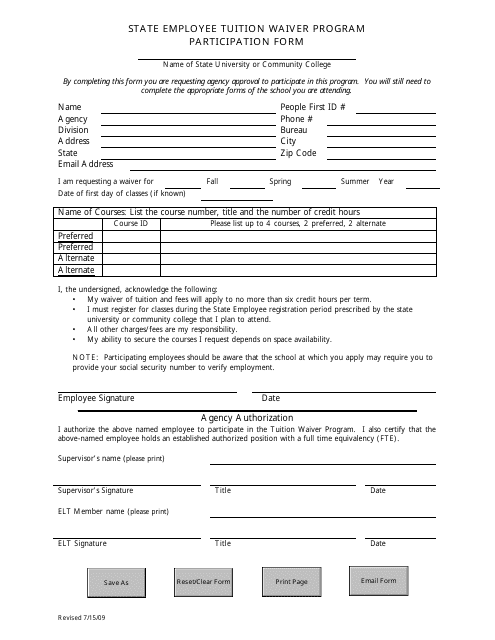

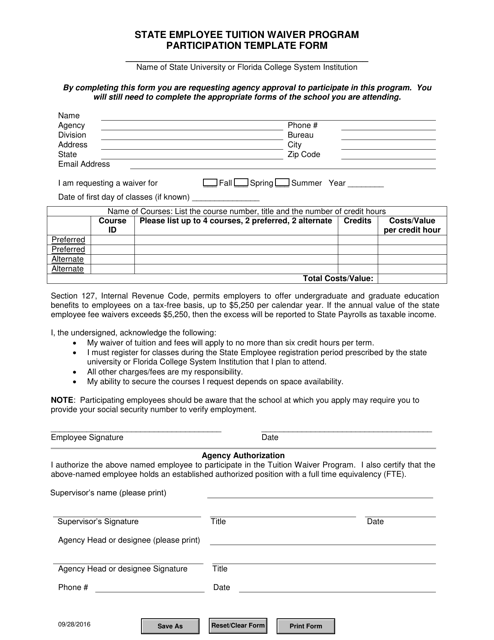

Florida State Employee Tuition Waiver Program Participation Form Download Fillable Pdf Templateroller

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Free Ontario Agreement Of Purchase And Sale Form Pdf 1796kb 5 Page S Real Estate Forms Agreement Ontario

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Exc Legal Forms Lease Templates

Florida State Employee Tuition Waiver Program Participation Template Form Download Fillable Pdf Templateroller

Florida Liability Release Form 3 Pdfsimpli

Florida Quitclaim Deed Form 3 Quitclaim Deed Broward County Legal Forms

Installment Payment Plan Agreement Template Inspirational 7 Installment Contract Form Samples Free Samp Contract Template Invoice Template Word Tuition Payment

Fill Free Fillable Forms For The State Of Florida

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Free Printable Eviction Notice Template 10 Best Eviction Notice Florida Form Blank Eviction Notice 30 Day Eviction Notice Letter Templates

Fill Free Fillable Forms For The State Of Florida

Free Customizable Real Estate Contract Template Templateral Real Estate Contract Wholesale Real Estate Real Estate Forms